Mr. Donald Jack

Accountax has been a game-changer. I haven’t looked back and can’t believe we didn’t sign up sooner. The team is amazing and the work they deliver helps us with things like planning for growth, expenses, fundraising, and more.”

At Accountax, We pair you with a team of experts who provide financial ready for everything

Request a consultation for our expert Accounting Team

Accounting services for Sole Traders

Preparing and submitting a self-assessment tax return

VAT registrations and returns

Automated reminders for your crucial deadlines

Mr. Donald Jack

Accountax has been a game-changer. I haven’t looked back and can’t believe we didn’t sign up sooner. The team is amazing and the work they deliver helps us with things like planning for growth, expenses, fundraising, and more.”

Mr. Donald Jack

Accountax has been a game-changer. I haven’t looked back and can’t believe we didn’t sign up sooner. The team is amazing and the work they deliver helps us with things like planning for growth, expenses, fundraising, and more.”

Mr. Donald Jack

Accountax has been a game-changer. I haven’t looked back and can’t believe we didn’t sign up sooner. The team is amazing and the work they deliver helps us with things like planning for growth, expenses, fundraising, and more.”

After joining us, we will assign a committed sole trader accountant to handle accounts. Our certified and experienced will be available to assist you in understanding your responsibilities as a sole trader.

You will get access to premium account software which will allow you to create quotes, send invoices to the customers, follow up payments, and track outstanding balances without spending much time.

On your behalf we help you submit tax returns and sole trader accounts to HMRC so that you can focus on your core business activities. We offer guidance on payment dates and tax rates. Also, we create financial reports for our clients to help them make smart business decisions.

Your committed sole trader accountant will be accessible to answer your queries related to your business. You can get in touch with them via live chat, email, phone or even connect with them one-on-one.

You will never miss out on any deadlines as we send automated reminders regularly to help you know the due date for the submission of returns and accounts.

We believe in offering a service that helps you save money. Hence, we review tax efficiency for sole trader accounts regularly so that you can save on taxes.

Fetch your online quote instantly to know how much you need to pay.

Filling up a simple registration form online to register your business. It is a simple short form that will not take much of your time.

We will process your request and connect you to your dedicated accountant.

Our experienced sole trader accountants can provide assistance to improvise overall financial operations to experience accelerated business growth.We coordinate with your previous accountant as well to gather the necessary information. With extensive experience in the financial sector, we help an array of businesses to optimize operational efficiency.

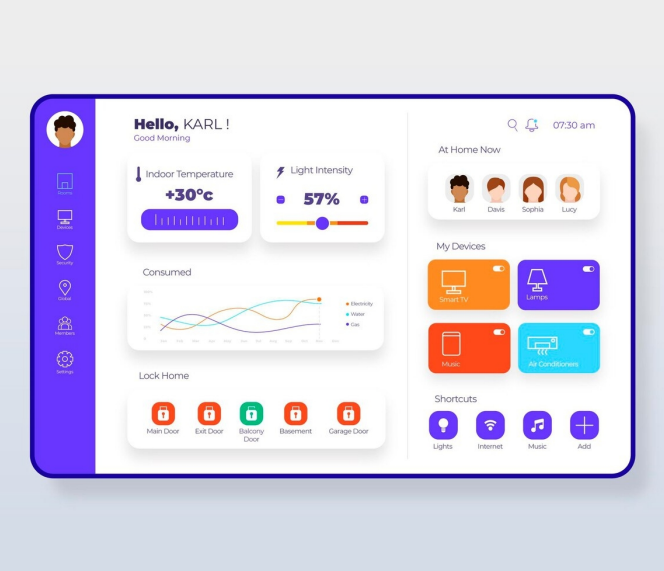

Experience our efficient accounting software designed to meet your daily financial activities. Organize and upload your crucial documents faster. Manage your sales, payments and invoices by connecting your bank account on this platform to get complete control over your accounts.

Link your bank and bring in your statements to adapt transactions. Transactions are recorded into our software every week.

Submitting and filing your VAT returns to HMRC is simplified as we file your returns via HMRC coherent software on a quarterly basis.

Experienced accountants are easily accessible to answer your queries to help you get financial clarity and make wise decisions.

Offers a range of reports like balance sheets, cash flow statements, profit & loss statements to help you get insights to financial health of your business.

Navigate through our FAQs to get answers

As a sole trader, you can claim expenses like business accountancy fees towards the time invested by your accountant in managing your sole trader accounts.

Well, there is no such rule that says a sole trader needs an accountant, but hiring an accountant helps you manage your business finances better, file tax returns etc. An accountant would add value to your overall business especially if the sole trade business is at its initial stage and needs help in different areas like CIS, VAT, and recruiting employees.

As a sole trader, you need to file related taxes with HMRC before the due dates. Firstly, you need to register with HMRC as a sole trade and register for tax returns like Self Assessment. Our team of qualified accountants also helps you file tax returns to HMRC on your behalf. In case you do not have an accountant, you need to file the taxes on your own.

Mr. Donald Jack

Accountax has been a game-changer. I haven’t looked back and can’t believe we didn’t sign up sooner. The team is amazing and the work they deliver helps us with things like planning for growth, expenses, fundraising, and more.”

Mr. Donald Jack

Accountax has been a game-changer. I haven’t looked back and can’t believe we didn’t sign up sooner. The team is amazing and the work they deliver helps us with things like planning for growth, expenses, fundraising, and more.”

Mr. Donald Jack

Accountax has been a game-changer. I haven’t looked back and can’t believe we didn’t sign up sooner. The team is amazing and the work they deliver helps us with things like planning for growth, expenses, fundraising, and more.”